cook county use tax portal

Prior to January 1 2012 the Cook County Use Tax Rate was ¾ of 1. The Property Tax System 1.

Cook County Property Tax Portal

Tax Extension and Rates The Clerks Tax Extension Unit is.

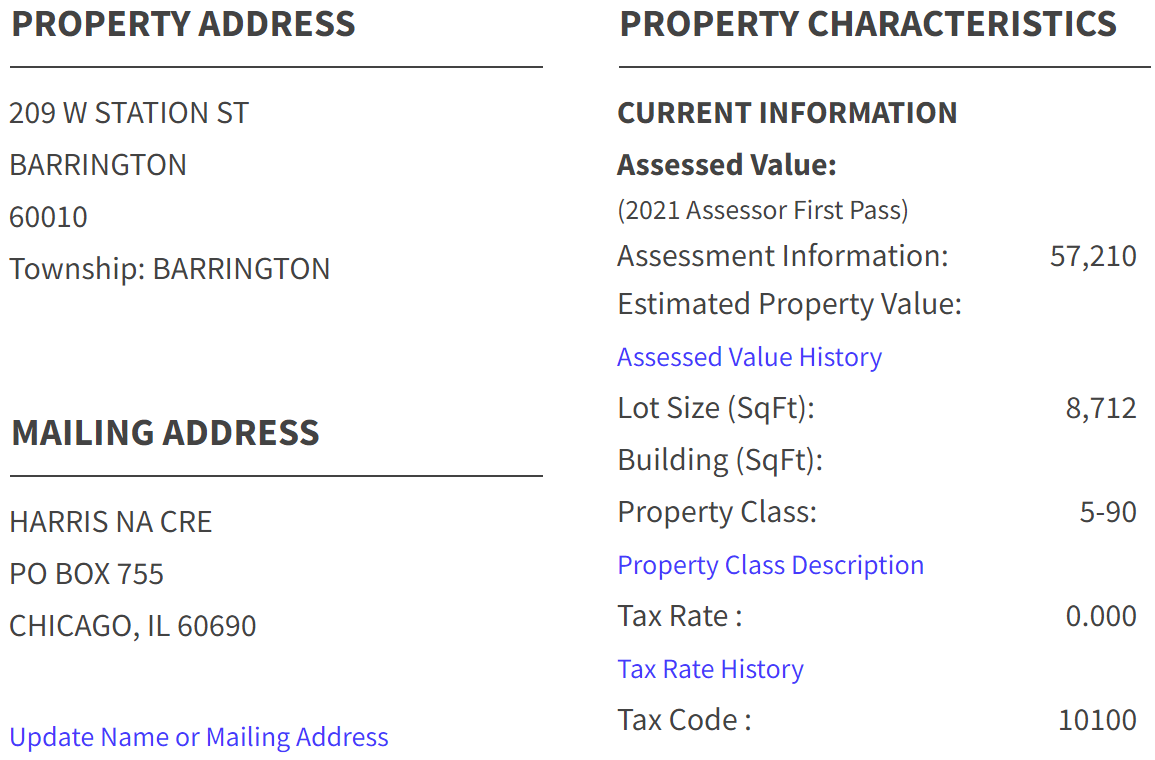

. PROPERTY TAX BASE The Assessor assesses all real estate located throughout the County and establishes a fair market value for each property. Tax Redemption If your unpaid taxes have been sold the Clerks office can provide you with an Estimate of the Cost of Redemption. The Property Tax System 1.

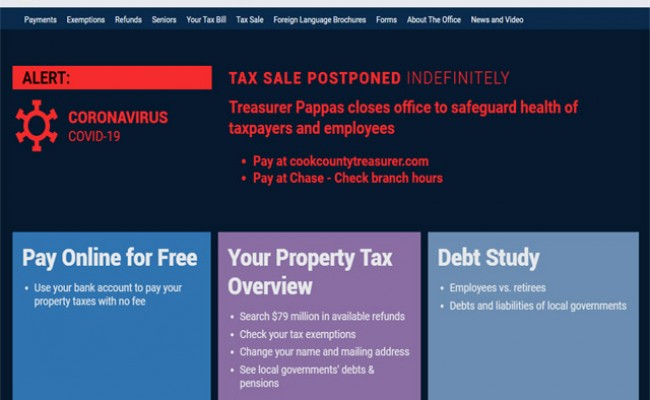

I DIDNT BUY MY CAR AT A DEALERSHIP I. We will continue to service our taxpayers but with limited availability. The mailing of the bills is dependent on the completion of data by other local and.

Property Tax Portal Pin Results Property Property Tax Outdoor Decor. Use Tax and Individual Use Tax Phone Number 312 603-6961 Use Tax and Individual Use Tax Cook County Purchaser Individual Use Tax customers can remit their payments one of three. The cook county treasurers office.

If you have any questions please submit a General Inquiry service request through your Online. To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer. The Portal consolidates information and delivers.

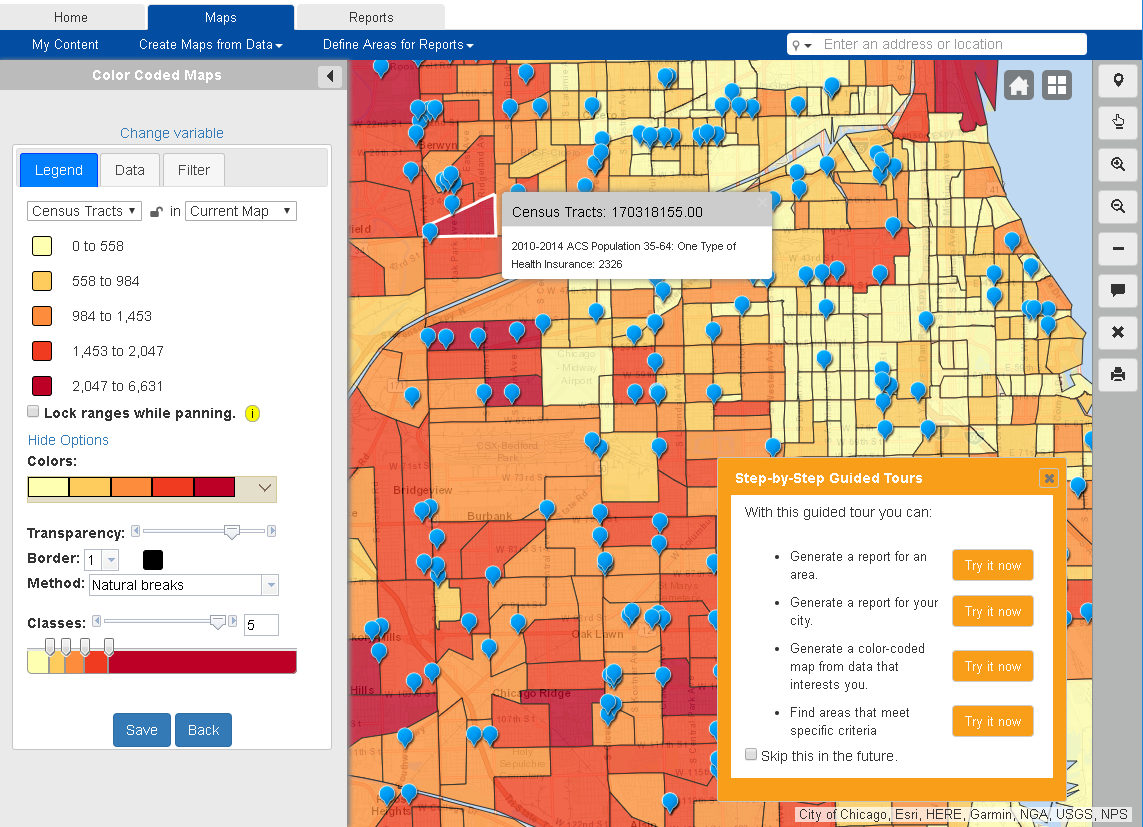

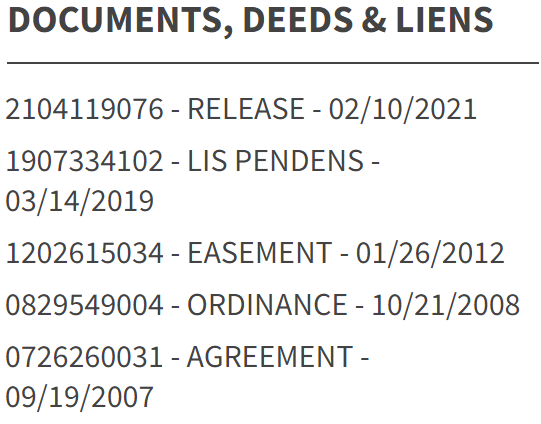

The Property Tax System 1. The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. For prior tax years and status please check with the Cook County Clerks Office for more information.

PROPERTY TAX BASE The Assessor assesses all real estate located throughout the County and establishes a fair market value for each property. If you do not know your PIN use the Search by Property Address link. As of January 1 2012 the Cook County Use Tax Rate is 1.

To make any tax fine or fee payments please pay online where available or by US Mail. If you have any. The Portal consolidates information and delivers.

Depending on classification the property is subject to forfeiture to the State of Minnesota. Cook county use tax portal. Mission The County Treasurers Office is responsible for collecting safeguarding investing and distributing property tax funds.

It brings together property tax data from the Cook County Assessors Office. The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. Property tax relief for military personnel.

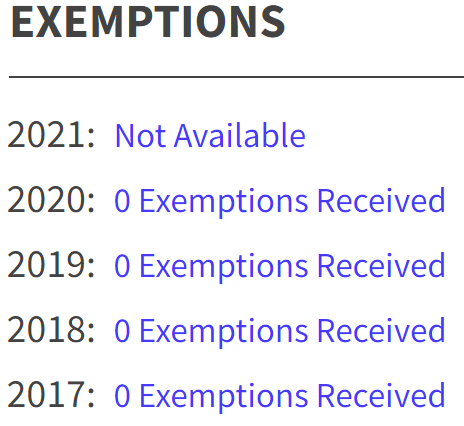

The Read More Raffles Department of Revenue. Mandates and Key Activities Prints and mails Property Tax Bills. The Tax Year 2021 Second Installment Property Tax due date has yet to be determined.

Real Estate Sales Info. The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. Failure to collect and remit the taxes may subject retailers to interest and penalties.

PROPERTY TAX BASE The Assessor assesses all real estate located throughout the County and establishes a fair market value for each property. Non-Retailer Use TaxGeneral InformationAn ordinance imposing a tax on the non-retail sale or transfer of tangible property titled or registered with an agency of the State of Illinois at an. The Cook County Property Tax Portal was developed and is managed by the Cook County Treasurers Office.

Property Tax Appeals In Cook County

Pay Cook County Property Taxes Through October 1 With No Penalty The City Of Hickory Hills Illinois

What Is My Home S Assessed Value In Cook County Kensington

Fritz Kaegi En Twitter In One Of Her Only Interviews Since Launching Her Campaign Four Months Ago My Opponent Refused To Say Whether Her Spouse Maze Jackson Would Keep Lobbying For Real

Farlap Associates Home Facebook

Search Recordings Cook County Clerk

Cook County Property Tax Portal

Cook County Property Tax Portal

Property Taxes City Of Evanston

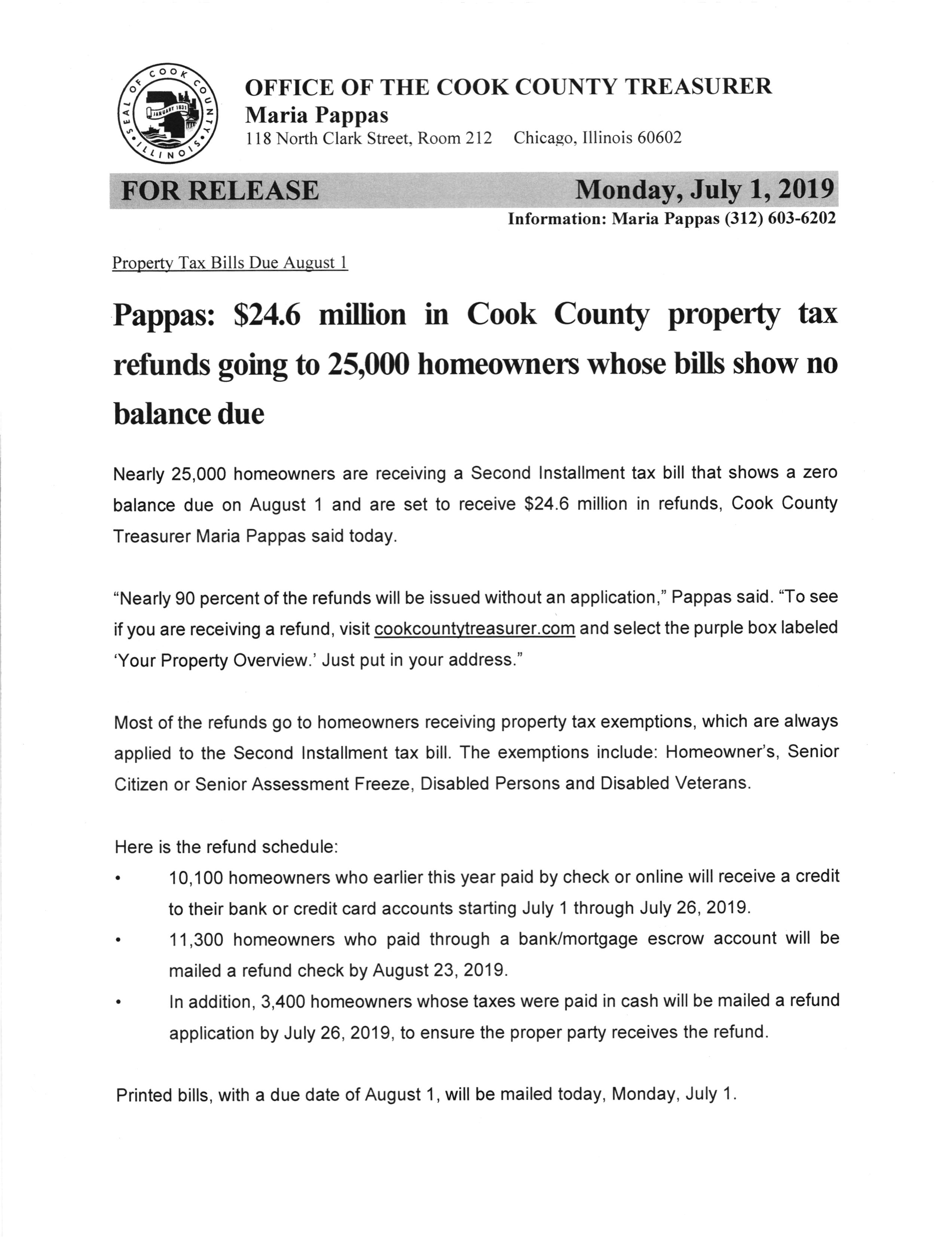

Cook County Property Tax Refunds Village Of Alsip

Cook County Property Tax Portal

Homeowners Find Out Which Exemptions Auto Renew This Year

Cook County Property Tax Portal Property Tax Property Cook County